Lawsnote | RegTech Compliance Solution

Lawsnote’s compliance solution helps businesses comply with regulations while enhancing the efficiency of their compliance efforts, reducing human resource costs, and streamlining compliance processes. It is categorized under the application areas of RegTech (regulatory technology) and compliance technology. Lawsnote’s solution has been adopted by TSMC and 20 other prominent companies within Taiwan’s financial industry.

Application Fields

- Financial industry compliance risk assessment:

- Update notification for law, draft law, interpretation, and sanction

- Internal/external regulations compare

- Business self-assessment

- Risk calculation

- Regulatory update risk monitoring: we provide customized monitoring rules and deliver notifications by requirement.

- ISO 37301/ESG complied management system

- Advertise judgment: for advertisement of financial products, cosmetics, skincare products, and health supplements.

Financial Industry Compliance Risk Assessment

Lawsnote’s financial industry compliance risk assessment solution falls under the category of RegTech solutions and is primarily designed for the financial industry to comply with the compliance risk assessment process required by the internal control and internal audit management regulations.

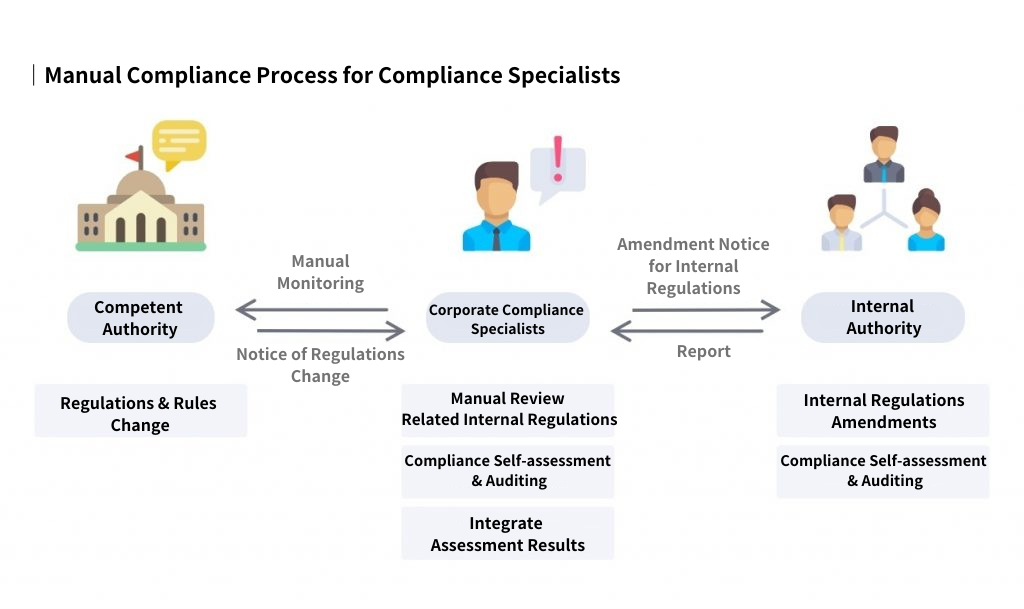

However, there is an overwhelming number of financial-related regulations, and the business units’ operational manuals are extensive and numerous. As a result, compliance specialist in the financial industry must dedicate a significant amount of time to handle the tedious tasks of regulatory monitoring and internal and external rule comparisons. This not only helps to prevent situations where internal regulations are not promptly adjusted in response to legal amendments but also ensures compliance with the regular inspections conducted by the Financial Supervisory Commission each year.

▲ Compliance specialists have spent a significant amount of time handling regulatory updates.

To make the compliance process in the financial industry more efficient and reduce manpower burden while enhancing compliance effectiveness, Lawsnote offers a Compliance Management System and related solutions for regulatory adherence.

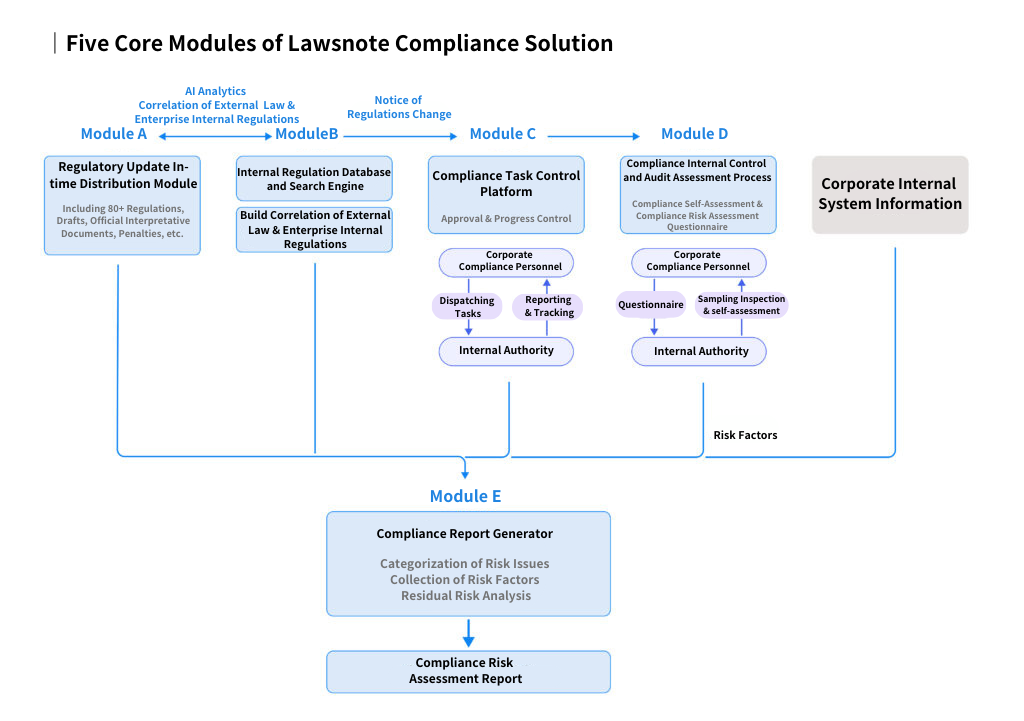

Aligned with the current compliance procedures in the market, Lawsnote’s Compliance Risk Assessment System supports various methodologies and can be seamlessly integrated with different modules of the existing systems adopted by the financial industry.

▲ Explanation of each module in Lawsnote Compliance Management System. Each module can be integrated with existing systems independently.

Five Core Modules of Lawsnote’s Compliance Solution

A. Regulatory Update In-time Distribution Module

As the foundation of RegTech compliance systems, compliance risk primarily arises from “regulatory updates” or “penalty information,” making it necessary to have a specific domain “comprehensive” and “real-time” regulatory database, as well as a mechanism for regulatory updates.

However, regulations are not limited to laws enacted by the legislature; they also include “administrative rules” and “regulatory orders” established by various administrative agencies under the authority of laws, as well as “administrative interpretations” used to interpret regulations. All of these are considered the regulations that a compliance system must follow.

Currently, these regulatory data do not have a unified source. In addition to the nationwide regulatory database, many regulations are scattered across different agencies, organizations, or association websites in separate regulatory pages, leading to a very high cost of collecting comprehensive regulations.

As regulations can be amended, and new administrative interpretations may be issued or abolished, maintaining real-time updates of regulations is also a significant challenge. Even if a one-time collection of complete regulations is achieved, failure to continuously monitor the changes and administrative interpretations could result in compliance gaps.

As a professional legal search engine, Lawsnote possesses a comprehensive database of regulations and interpretations, catering to the compliance system needs of various industries and providing notifications for required regulatory updates in different fields.

The database covers over 80 data sources, meeting the diverse demands of various financial industries and supporting daily notifications. The types of legal information include:

- Regulatory orders

- Administrative rules

- Administrative agency interpretations (interpretative letters): including abolishment and deactivation information.

- Penalties: major and non-major penalties

- Drafts

- Self-regulatory norms of associations

- Other documents: announcements, FAQs, flowcharts, templates, operational specifications, revision comparison tables, and english documents.

B-1. Internal Regulation Database and Search Engine

The internal management of a company through regulations are “Internal Regulations” or “Internal Rules.” Common types of internal regulations include internal policies, standard operating procedures (SOPs), and business guidebooks. The number and density of internal rules may vary depending on the intensity of regulatory oversight in the industry.

In industries with high regulatory density, the quantity of internal regulations can sometimes reach thousands or even tens of thousands. With such a vast volume of internal rules, relying on paper-based or simple file systems becomes inadequate to meet the company’s internal needs. Without establishing an internal regulation database and search engine, to find and to adhere to internal regulations may lead to significant time consumption and waste of human resources.

Lawsnote possesses Taiwan’s most powerful legal data search engine, leveraging patent search technology and applying artificial intelligence to optimize sorting algorithms. This enables the establishment of an “Internal Regulation Database” with enterprise internal documents such as policies, Standard Operating Procedures (SOPs), and guidebooks. The search engine technology is then applied to the Internal Regulation Database, achieving a fast, comprehensive, and user-friendly internal regulation database and search engine.

B-2. Build Correlation of External Law & Enterprise Internal Regulations

When an external rule is amended, internal regulations should be updated accordingly.

The internal regulation review process may be initiated by compliance specialist based on regulatory amendments or by the compliance supervisor of the business unit (the first line of defense) and then verified by compliance specialist (the second line of defense). However, regardless of who initiates the process, the challenge lies in identifying the corresponding internal regulation articles related to the amended regulatory articles to determine if adjustments are necessary.

Due to the vast number of internal regulations, complex terminology, and involvement of various business forms within the company, conducting a comprehensive review of internal rules for every regulatory amendment would consume significant time. Therefore, compliance specialist often rely on their experience to strike a balance between limited time and minimizing risks.

Furthermore, the internal rules are often modified and disassembled, making programmatic comparison extremely challenging. Simply using existing programs to compare internal and external regulations could lead to mis-judgment.

After researching and testing, Lawsnote has designed three artificial intelligence algorithms and four rule-based algorithms for cross-referencing. These algorithms enable the establishment of “article-to-article” correlations between thousands of regulations and business’ internal rules. This assists compliance specialist in determining the necessity of adjusting internal regulations promptly during regulatory amendments, significantly reducing the time required for inventorying and mitigating compliance internal control risks.

C. Compliance Task Control Platform

Due to the inherent risks arising from regulatory updates, each business unit has to formulate control measures to mitigate the risks caused by regulatory changes. After each business unit generates the control measures, compliance units need to check and follow up on these tasks accordingly. Additionally, through the annual compliance risk assessment process, the performance of each business unit in controlling the risks of regulatory updates is assessed and inventoried.

Lawsnote’s compliance task control platform features task assignment, approval, tracking, and statistical functions. It offers flexible support for different enterprises’ approval processes, substitute systems, and permission controls. Additionally, it can be seamlessly integrated with the company’s single sign-on mechanism, making the compliance control measures task workflow easily connected with the existing system.

D. Compliance Internal Control and Audit Assessment Process

To ensure business unit compliance supervisors have implemented compliance procedures, some companies adopt mechanisms such as compliance self-assessment and compliance education into the workflow. Through the assessment scale of compliance self-assessment, business unit compliance supervisors are required to evaluate the internal control and internal audit processes for regulatory compliance and identify existing risks.

Compliance specialists or auditors must consolidate the results based on the self-assessment or create risk matrices for compliance risk monitoring and tracking of identified weaknesses.

Lawsnote’s solution supports the extension of workflows to include compliance self-assessment processes. It enables seamless customization and integration of existing systems with the compliance system. By combining organizational structures and mechanisms like single sign-on and permission controls, it achieves a comprehensive and integrated one-stop compliance solution.

E. Compliance Report Generator

Financial institutions that have implemented the compliance risk assessment process have to produce a report annually, and submit to the Financial Supervisory Commission based on the outcomes of compliance adherence. The report should include an overall assessment of compliance level, risk management, self-assessment by business units, and the calculation of residual risks and proposed improvement plans for the following year.

Lawsnote’s compliance risk assessment module can incorporate various reference factors from different sources. It can also adapt and adjust risk coefficients based on different compliance methodologies, helping compliance specialist quickly generate compliance risk assessment reports.

Success Cases

Shin Kong Financial Holding Co., Ltd.

Cathay Financial Holdings Co., Ltd.

SinoPac Financial Holdings Co., Ltd.

Contact Us

Feel free to contact us for more information about the RegTech solution.